Welcome to the forefront of conversational AI as we explore the fascinating world of AI chatbots in our dedicated blog series. Discover the latest advancements, applications, and strategies that propel the evolution of chatbot technology. From enhancing customer interactions to streamlining business processes, these articles delve into the innovative ways artificial intelligence is shaping the landscape of automated conversational agents. Whether you’re a business owner, developer, or simply intrigued by the future of interactive technology, join us on this journey to unravel the transformative power and endless possibilities of AI chatbots.

10 Ways Generative AI is Transforming the eCommerce Industry

Unveiling 10 Use Cases, Benefits and Examples of Physical AI

How to Build an AI Copilot for Enterprises? Process, Costs, and Features

How AI Agents Are Revolutionizing Fraud Detection in Financial Services

How Agentic AI is Revolutionizing the Financial Sector: A Deep Dive for the C-Suite

How AI is Transforming Employee Experience and Boosting Engagement and Productivity

AI in Sustainability – How Businesses Can Leverage AI for Environmental Impact

15 Use Cases on How AI Is Transforming Virtual Reality: The Future of Immersive Experiences

AI in Warehouse Management: Benefits, Use Cases, and Real World Examples

How to Use AI in Personalized Treatment Plans for Diseases?

A leading digital platform to offer engaging shopping experience to users

A mobile app to digitalise & expand KFC’s digital footprint

The MIT Innovation award-winning app withh $52 million funding reshaping the employment lanscape.

A transforming ERP solution for the world’s largest furniture retailer

A refined UX strategy for Domino’s to increase their conversion rate by 23%

A SaaS-based financial literacy and smart money management platform for kids

How Much Does It Cost to Build a Safety Observation App?

Staff Augmentation vs In-House Hiring: Which Is the Better Model for Your Business?

10 Ways Generative AI is Transforming the eCommerce Industry

How Much Does It Cost to Build a Healthcare App?

How Much Does It Cost to Build an AI Product?

Green App Development – The Ultimate Entrepreneur Guide to Building Eco-Friendly Mobile Apps

Appinventiv Forges Strategic Alliance with Ingram Micro to Accelerate Enterprise Digital Transformation

Appinventiv Solidifies Global Leadership, Secures Position on Australian Government’s Digital Marketplace

Appinventiv Launches NIST CSF-Based Security Framework to Fortify Healthcare Operations and Ensure Compliance

Go vs Rust: Which is Better and Why?

How to Build AI-Powered Dating Apps: A Step-by-Step Guide

Blockchain in Fintech: A Catalyst for Disruption in Finance World

Blockchain vs DLT – An Explanatory Guide You Can’t Miss On

How to Streamline Your Real Estate Business With Construction Project Management Software

How Will Blockchain Benefit the Agriculture and Food Industry in the Future?

Key takeaways:

Did you know there is a costly connection between your payment services and your business revenue? Yes! According to Fintech Times, 45% of consumers won’t retry a payment following a false decline – and 42% are reluctant to return to an app or website after such an experience.

Thus, running your payment app or website without AI is like teetering your business on the edge of chaos, battling pain points that leave you in the dust, trying to figure out what hit you, and ultimately threatening your survival in the market.

A smart AI payment system is adept at predicting the rush, catching fishy behavior as it happens, and dishing out deals that make folks happy to hit pay. Fast-forward to 2025 in the payments realm—AI is no longer just a helpful gadget—it’s what separates the hotshots from the no-shots.

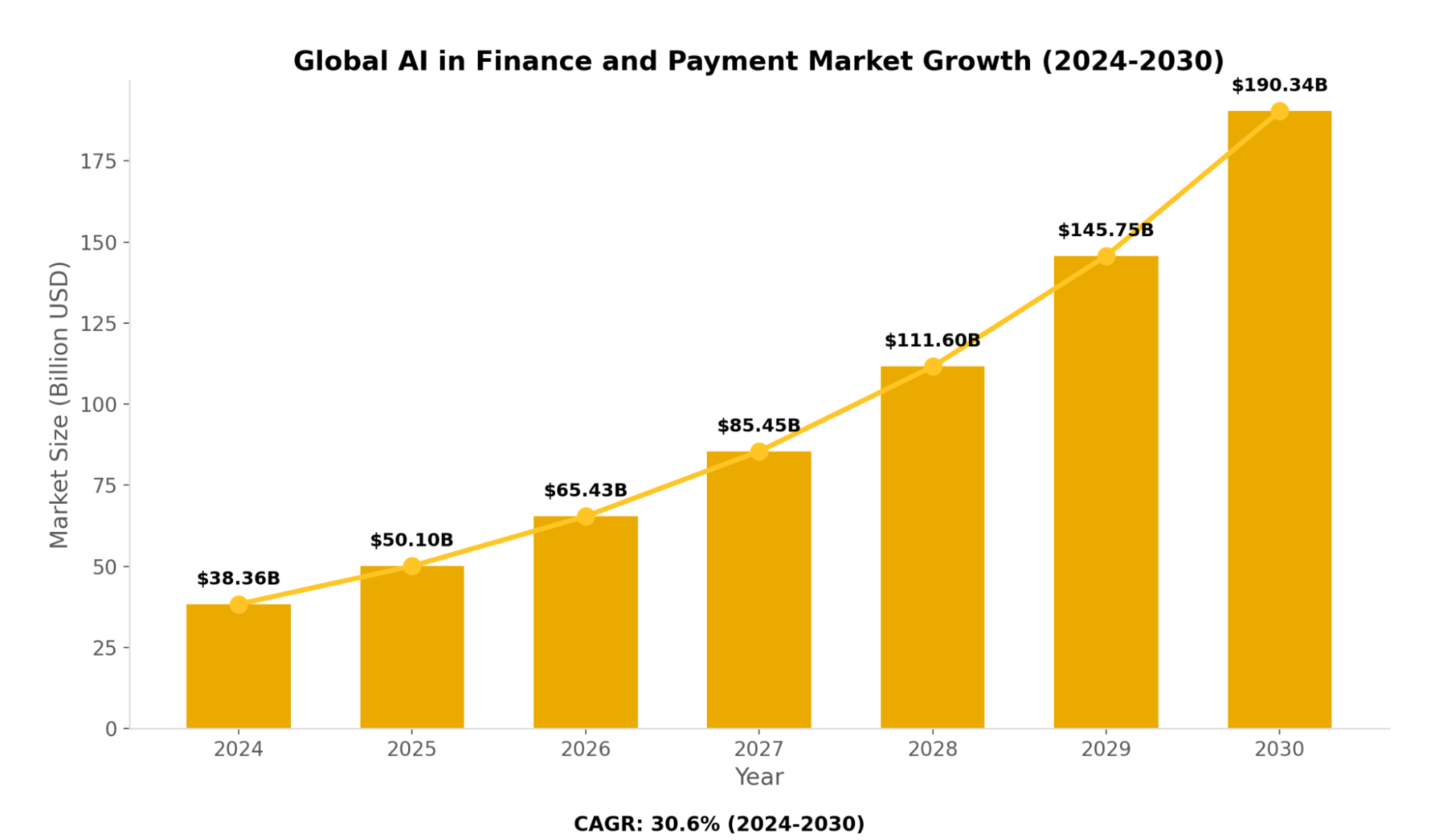

The global AI in finance and payment market was estimated at USD 38.36 billion in 2024 and is expected to reach USD 190.33 billion in 2030, with a compound annual growth rate (CAGR) of 30.6% from 2024 to 2030 (Source: Markets and Markets).

By 2025, AI will become a key part of paying for things, changing how we make, process, and protect transactions. This change affects two main areas: how customers pay and how businesses handle payments.

AI gives them tools to improve their work, fight fraud, and connect with customers better. This helps them work more and make more money in a tough market.

AI makes paying easier, safer, and more personal. It meets the growing need for smooth and customized money experiences.

These improvements show a big change. AI doesn’t just make payments faster – it changes how customers and businesses interact with each other and with the technology that links them.

This part looks at these two viewpoints, shedding light on the new ideas, hurdles, and future promises of AI in the payments industry as it keeps changing.

Therefore, Artificial intelligence in Payments brings awesome new levels of quickness and safety, making things way more personal for everyone. Think about how we’re using digital wallets and cryptocurrencies; AI’s the big brain behind all the cool changes happening in the payment world. This post will dive into the journey of AI in the payments industry, the gear that’s making all this magic happen, the real-deal uses we’re seeing, and tips for companies looking to tap into this power.

Artificial intelligence in payments stands ready to tackle these obstacles, turning the payment field into a domain that’s slicker, safer, and easier for folks to use. Check out how:

AI examines how transactions flow, foresees busy times, and tweaks the process chain to make systems expand. Machine learning in banking & finance adjusts what resources go where on the fly, dodging slowdowns and letting platforms manage loads of transactions with no problem.

Systems need to work together – that’s what interoperability means. It’s super important for a payment system that makes sense together. If we don’t have it, people dealing with payments get all mixed up, and companies must deal with mismatched systems.

If you’re a shop owner trying to take CBDCs, good luck fitting that square peg into the round hole of your old credit card or PayPal setup at the cash register. This will ensure money can slide through different countries and tech without a hitch.

AI speeds up the check and completion of transactions with its knack for handling huge data sets. Neural networks can spot weird stuff or scams and say yes to good payments in a flash. At the same time, they call out iffy things to look at.

AI is top-notch at catching patterns that might slip by us. It monitors money moves for anything odd, like spending that suddenly skyrockets or logging in from a strange place. This helps stop scammers in their tracks. Also, stacking up top-end code scrambling with AI’s ability to sniff out dangers gives us a strong shield against online baddies.

AI-powered Chatbots take the hassle out of settling payment quarrels and tailor the way you pay, making things feel seamless and natural. It’s got a knack for guessing what you might not, nudging you towards Apple Pay for a speedy tap or a crypto wallet when you don’t want to get hit with fees. Plus, it’s all about cutting down on the bumps along the way.

The internet payment biz has changed with artificial intelligence in payments, joining forces with related tech. These gadgets make things safer, better the user experience, keep stuff running smoothly, and stick to the rules. Here’s a look at the usual AI stuff making waves in this field.

Machine Learning Algorithms—part of AI—let payment setups get smart on their own from tons of info without anyone telling them what to do. They’re a big deal in the online payment world, and here’s how:

NLP applications for modern enterprises allow computers to grasp and reply to what we say, causing a revolution in how customers interact within the money-moving world:

AI-Powered Chatbot App: Mudra Budget Management App

Appinventiv’s AI experts have engineered an AI-powered Chatbot App – Mudra budget management solution. See how AI integration and automation align with advanced financial and banking principles by delivering personalized, efficient, and engaging user experiences:

Results

Mudra: The Budget Management App turns budget management into a dynamic, user-focused experience. Its success, spanning 12+ countries, reflects this AI-aligned strategy, where technology solves practical problems while forging a trust-based bond with users.

Generative AI in finance is known for forming new stuff or solutions from patterns it learns and is getting pretty popular in the money-moving world:

Now, blockchain in fintech, often seen hanging out with AI, sets up a tight and open-as-a-book base for systems that handle your cash:

AI’s giving Decentralized Finance (DeFi) a big boost, what with making money work smarter, keeping an eye on the risky stuff, and playing by the rules:

Analysis of data taps into big data piles to pull out useful clues that help crank up efficiency and make things super personal:

Biometric securities in digital banking lock things down tight with your one-of-a-kind body features, making sign-ins a breeze without any hitches:

When it comes to visual info, computer vision is on the job. It makes sure payment stuff is tight and follows the rules.

Bonus Read: Financial Regulatory Compliance Software Development For Compliance Checks

Even though it’s kinda new, quantum computing is set to cause a revolution in how money matters work with mind-blowing speed in crunching numbers:

Mixing AI with rules and regulations? That’s RegTech for ya. It’s all about sticking to the law and being super efficient with our payment networks.

Bonus Read: AML Software Development – A Detailed Guide for CEOs

Put it all together; these smart tools are a big deal; they make online money moves quick, tight, and more tuned into what folks need while figuring out the crazy rule maze. As this tech keeps improving, it will switch up the game on handling cash online, making it cooler, slicker, and much safer.

Use cases of AI in payments change how we deal with transactions in the payments world. It’s making sure things are safe and personalizing how customers experience everything. AI’s bringing some big-time shifts to all things money-related. We will talk about five major use cases of AI in payments that shake the industries. These applications of AI in payments are all about making stuff easier, getting better results, and leading the charge into a new wave of dealing with cash.

Machine learning algorithms are part of AI for payment fraud prevention. They’re built to handle loads of data quickly and precisely, perfect for watching over transactions as they happen. Let’s break it down bit by bit:

1. AI for payment fraud detection kicks off by collecting crucial details. This includes people’s purchases, their identities, locations, and when they buy stuff. These pieces of information lay the groundwork to identify fishy actions.

2. The next step is machine learning, which takes two forms: supervised and unsupervised. It scours past data to nail down what’s considered ‘normal.’ Think about someone who drops $50 to $100 on grub weekly in their city. That’s our comparison standard.

3. After that, AI in B2B payments starts checking out stuff, and as it happens, it keeps an eye out for weird things. For example, if someone goes wild with a $5,000 blow-out while they’re chilling abroad, The neat part is it isn’t just about basic rules. It dives headfirst into the nitty-gritty — things like how fast the transaction happens, what kind of gadget is used, IP location, etc.

The system halts fraud the second it spots it. It also keeps getting smarter with new info, improving its scam-catching skills as time passes.

Being a big shot in internet cash moves, PayPal sees tons of action with billions of deals. That puts it in cheaters’ crosshairs. However, PayPal has AI-based trick-spotting tech that handles the huge workload. Here’s their tech play:

PayPal’s AI-powered setup has shown great success:

Risk assessment is all about identifying, analyzing, and evaluating potential dangers. It’s big in areas like finance, e-commerce, insurance, and more, helping to dodge losses from fraud not paying back loans or bad surprises. Throw AI into the mix, and you’ve got yourself a quicker risk assessment process and nail the accuracy without breaking a sweat.

Stripe is a big deal regarding online payments, and they use AI in B2B payments to determine if a business is risky when it first signs up. This part’s important to ensure the companies that hop on their platform aren’t about to pull any shady moves or rack up a bunch of chargebacks. Let’s check out how they pull it off:

Data Examined: Stripe’s AI looks at different clues, including:

Method: When a seller asks to join Stripe, the AI slaps a risk number on these bits of info. Sellers on the risky side could get extra eyeballing or the boot, but the safer bets get the green light quicker.

The AI in banking and payments achieves 70% greater precision in identifying legitimate transactions that have been falsely declined. This increased precision allowed us to recover more revenue than ever last year while reducing retry attempts by 35%. (Stripe)

Sending money across national borders involves different parties in distinct countries. This includes folks wiring cash to relatives overseas, firms settling bills with foreign vendors, or big-time company transactions.

Getting cash across borders has been a drag, costing an arm and a leg and taking forever due to dealing with different money types, following the rules, and sneaky extra charges. It takes 3-5 workdays and might munch away 5-7% of the cash you’re sending in charges and rate hikes. This hassle has sparked serious brainwaves among fintech whizzes who use tech and AI to make things smoother.

AI in cross-border payments is causing a revolution. It analyzes data, makes everything smoother, and reduces mistakes. It uses past data and patterns to predict currency changes, which improves exchange rates and reduces risks. AI in cross-border payments also picks out the best ways to send money, choosing options like SEPA that are quicker and cheaper than old-school methods.

It checks that payments stick to rules like AML, KYC, and sanctions super fast by reviewing transactions and understanding the legal stuff with NLP. AI looks at payments as they happen, dodging problems and spotting scams in the nick of time. AI chops costs and moves your money faster by ditching the intermediaries, tuning the rates, and using machine learning tricks.

Wise, this fintech biz shook up how we do cross-border payments for real. These AI programs are watching and guessing where currency pairs, like USD to EUR, are headed. The AI at Wise checks out all their bank buddies and payment pals across the globe to spot the route that’s gonna cost you the least and get your money there quickly.

Plus, it does all that KYC stuff, like looking at IDs on autopilot, peeking at transactions to ensure they’re not on any no-no lists, and keeping everything up and running without dragging its feet.

According to the Wise:

Banks, fintech companies, and tons of other businesses need to know who their customers are, right? That’s where Know Your Customer (KYC) comes in super handy. It’s all about making sure people are who they say they are so that no one’s pulling a fast one—like doing fraud, washing dirty money, funneling cash to bad guys, or other sketchy stuff.

OCR powered by AI zaps through the job of pulling text out—stuff like names, digits, and MRZ deets—from IDs, including snaps of passports that aren’t top-notch. Then NLP jumps in to check the OCR’s work for goofs, ensuring things like where you live add up when you look at different documents.

The tech gets super smart when it comes to matching your fresh selfie with the one on your ID, and it even keeps an eye out for natural moves, like a blink, to make sure you’re the real deal. As it digs deeper, the AI in banking and payments gives a once-over to info with sources outside its backyard, think government files or those PEP lists just to catch any shady business.

Revolut hails from the UK and is deemed a fintech unicorn. It stands out as a leading instance of AI-enhanced KYC. Kicked off in 2015, this powerhouse provides banking solutions, including accounts, cards, and a platform for crypto trading. Here’s a look at how it leverages AI to run KYC:

New folks downloading the app toss in a photo of their ID, like a passport or driver’s license, and snap a selfie in the Revolut app.

The verification stuff sorts itself out on the spot; no people are needed, though the tricky ones might get a human taking a peep.

Revolut noticed a 30% drop in the money lost to fraud from card scams linked to fake investment chances (Revolut).

IVR Payments are things where people pay bills over the phone, right? They just hit numbers on their phone to follow the robot voice’s commands, like hitting “1” to fork over cash for a bill. You ring a number, wade through some options, punch in your card details, and boom, your payment’s done. You don’t even have to chat with a real person!

This fancy system hooks up to a payment gateway that keeps everything up-and-coming, sticking to these super-tight security rules called PCI DSS. Many companies use IVR to handle lots of payments super-fast, slash the cash they spend on operations, and let folks pay any time they want.

AI takes IVR payments to the next level by making them more intuitive and user-friendly. Here’s how it works:

American Express has a knack for staying on the consumer’s mind. They’ve made their rewards program so alluring that folks often sign up without a second thought. Plus, American Express is at the top of the list for cool promotions and partnerships that keep things fresh.

American Express uses AI well in IVR payments. It mixed AI with its IVR to let folks with their cards handle their stuff, like paying bills, by just talking.

Say someone with an Amex card rings them up, the AI helper pops up, tunes into what they wanna do (‘I’d like to pay my balance’), and then helps them out. It might say, “Wanna use the card ending with 1234?” or ask, “How much are you paying?” This thing is smart—it grabs your account info on the spot, gets the payment done through something super safe, and tells you it’s all good, so you don’t even need to chat with a real person.

Amex brought this into play to make things smoother and make folks happy with their cards using smart stuff like NLP and machine learning.

AI’s role in updating Amex’s phone service led to noticeable improvements (DestinationCRM):

AI in payment processing is causing a revolution in how companies manage their money moves. It gives a chance to make things smoother, beef up security, and make customers happier. Slipping AI into what you’ve got for payments might sound scary, but tackle it with a plan, and it’ll switch things up. Okay, let’s break it down into steps to get it done.

Start by taking a good look at what’s already in place. Find the scope of embedding AI in payment processing setup as it stands. You wanna know the nuts and bolts so that when AI steps in, it feels right at home. This doesn’t have to be a headache—just a solid check-up.

Kick things off by figuring out your current position. Start by checking out the payment processes you’ve got going—zero in on how you handle business, spot fraud, and manage reconciliations. Look for trouble spots holding you back or hitting your wallet, such as slow deals or fraud rates that are going up. After that, see if your setup is ready to buddy up with AI. Got your APIs in the latest shape? Is your info the kind that AI can jive with? Doing this assessment lays the groundwork.

AI’s no fairy tale fix; it demands clear orders. Aim for precise outcomes you want to nail. You could be looking to chop down fraud figures by 20% or slash the time deals take right down the middle. Connect those aims to the big picture, like making clients happier or reducing what it costs to run your show. Solid targets ensure the team’s on the same page and make it simple to check how well you did when it’s all said and done.

Every AI tool varies in capability. Pair the tech with your requirements. Machine learning models are top-notch requirements for detecting tricky fraud trends, and natural language processing amps up chatbots to provide better customer help. Mind how well the tool can expand. Is it built to develop along with your business? Also, think about cloud solutions that are quick and easy to implement versus having your setup on-site, which offers more command but costs more at the start. The assistance you get from sellers is super important as well. Choose allies who will stay the course.

Make sure your data’s ready for AI because it needs it. You gotta scoop up all that historical payment stuff – we’re talking records of transactions, reports of sketchy things, chats with customers – and give it a good scrub to eliminate any double entries or missing bits. And hey, you can’t ignore privacy rules like GDPR or CCPA, so keep the personal details down and play by the rules. To make your AI super snappy in real-time, get data pipelines going that zap all the new info straight into your algorithms the moment money moves.

Ease into it; don’t just dive in headfirst. Start small, like trialing AI to catch fraud in just one type of transaction, for example, those done with credit cards. You should keep an eye on things that tell you how well it’s doing, like how often it flags that it’s okay or how quick it is. This mini-test will help you find problems, fine-tune things, and get confident before you go big.

Time to hook up the AI with your current cash-moving tech. Use APIs or go-betweens to connect your cool new tools to the old stuff you have. Try not to shake things up too much—bring it in bit by bit and make sure it can play nice with old tech so you don’t break anything. Testing is super important because messing up here could cost you money or make customers mad.

Make sure your crew gets the hang of the AI. Show them the ins and outs, what the AI looks for, and how to step up when it’s called for. Don’t just leave the AI alone—establish observation methods to catch when model drift happens (like when it starts missing the mark because patterns change) and maintain strong performance. It’s key to touch base to confirm it’s living up to expectations.

After the pilot shows its value, it’s time to level up. Apply AI to more areas—consider sorting out how folks can pay or guessing upcoming cash flow. Craft feedback loops for consistent enhancements: as your customers’ habits transform, your algorithms should, too. The work to perfect the system never stops—remain adaptable and persist in polishing your approach.

Putting AI to work in your payment setup is more than just a tech move—it’s a savvy step for your biz. Check out what you’ve got, figure out where you wanna go, and grow with care. Kick things off on the down-low, pick up the pace, and peek at how your payment process gets slicker.

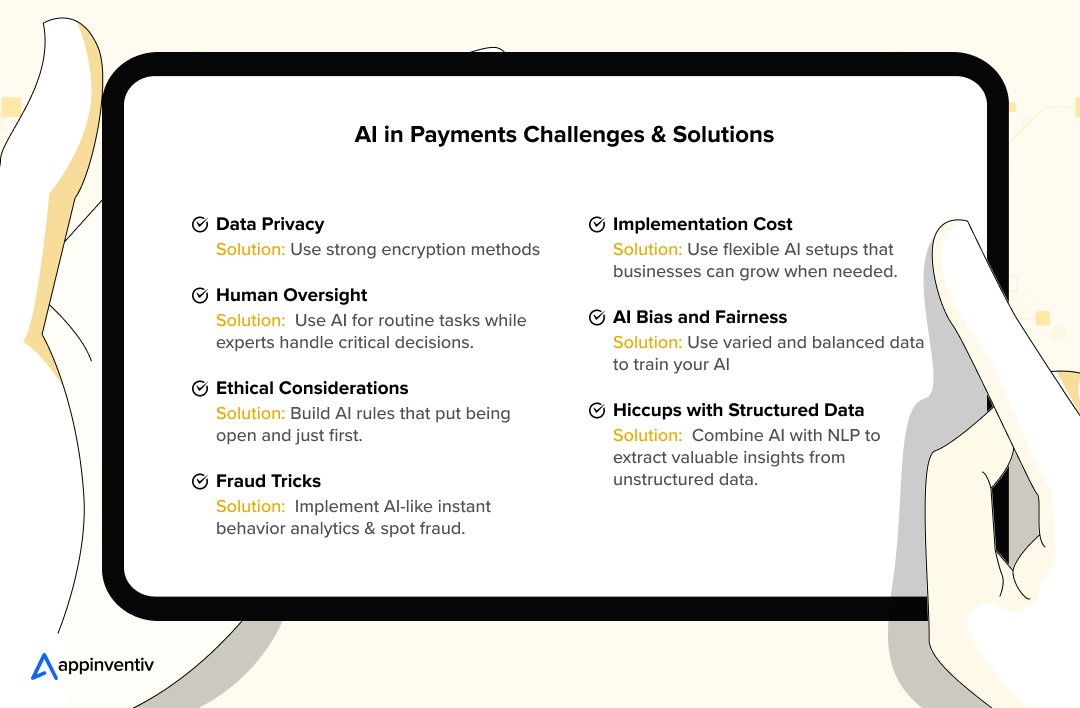

In the payment world, AI is causing a revolution, speeding up transactions, improving the ability to spot fraud, and making the shopping experience super personal. Yet, there are many big problems when you mix AI with money. We’ll dive into these challenges of AI in the payments industry and devise some smart ways to fix them.

AI must gobble up lots of information about us to do its job right. But folks are kinda worried about who’s grabbing their personal and bank details, where that data’s lounging around, and what people are doing with it. Plus, with all these rules like GDPR and CCPA, if you mess up, it’s gonna cost a ton and make you look bad.

Solution: Use strong encryption methods and make personal data anonymous to keep it safe. Stick to privacy-first ideas, ensuring they fit worldwide data protection rules. Regular checks and clear data methods can also make customers trust you more.

Even though AI can do some stuff independently, it can sometimes mess up. If we rely too much without people checking on it, we can make mistakes, get things wrong, or cause stuff we didn’t mean to happen in how we pay for things.

Solution: Go for a mixed plan where AI takes care of the easy stuff, but people with know-how keep an eye on the big choices and jump in if weird stuff pops up. Always watching how things are going and giving feedback can improve AI and keep everyone informed about who’s responsible.

AI handling payments needs to deal with tricky moral issues. It’s gotta make sure everyone has the same chance to use financial stuff and not do anything shady. Like, there’s a chance that robots might leave out people who don’t get these services, or they might care more about making money than being fair.

Solution: Build AI rules that put being open and just first. Get people involved when you’re making it, and do ethics checks often. This way, AI will match up with what people think is right and not cause trouble.

While AI is getting better at spotting cheats, the bad guys also use AI for trickier stuff. They’re coming up with things like fake identities or scams using deepfakes. It’s like a constant battle, with security and crooks always trying to one-up each other.

Solution: Implement cutting-edge AI-like instant behavior analytics and spot oddities to get the jump on new threats. Team up with IT security whizzes and exchange know-how industry-wide to get ready to block scam tricks.

Systems for making payments mess with neat data like transaction logs, but AI is all about mixing it up with varied, messy info. Wonky or not, whole data can mess with AI’s game by giving spot-on hints or guesses about what’s coming.

Solution: Roll out data prep moves to tidy up and make the data consistent. Mix AI with cool tools such as NLP to pull out the good stuff from messy sources, such as what customers say or help requests, making the whole system work better.

Setting up and keeping AI systems for payments can cost a lot. There are bills for skilled gear people and for keeping the system current. Small companies might have a hard time getting these techs.

Solution: Start with small, flexible AI setups that businesses can grow when needed. Work with other companies or use open-source tech to keep early expenses low while staying on top of the latest innovations.

Sometimes, AI systems pick up biases from the data they learn from. This can lead to not-so-fair decisions like who gets a loan approved or who gets flagged for fraud. It’s not cool since it can hit some groups of people harder than others, making folks doubt the system is fair.

Solution: Use varied and balanced data to train your AI and keep checking to make sure it’s not biased by using tests designed to measure fairness. Go for AI that explains its choices so you can spot and fix biases if they pop up.

We at Appinventiv lead the way in fusing artificial intelligence (AI) into the payments scene. This move is shaking things up, making how companies and people deal with their money moves differently. Our payment software development services perfectly blend AI expertise and digital acumen to help businesses lock things down tight, make their work smoother, and give customers something just for them.

Having a solid history of working with huge brands like KFC, Domino’s, and IKEA, creating payment systems that grow with the market and keep things safe and fresh for the fast-paced online world.

Let’s dive into how we make a splash in AI for payments, showing off our top-notch skills and services.

We at Appinventiv take a well-rounded approach to AI in payments, blending cutting-edge tech with a focus on client needs. We first put security, growth potential, and adaptability, creating answers that tackle today’s requirements and prepare businesses for what’s coming.

From protecting transactions to streamlining processes and tailoring experiences, Appinventiv stands as a reliable ally in dealing with the ins and outs of today’s payment scene. Contact us now!

Q. What is AI in Payments?

A. AI in digital payments means incorporating smart computer systems like machine learning, language understanding, and data analysis into how we handle money transactions. It uses AI to improve financial processes, including how payments work, staying secure, spotting fraud, and improving customer interactions.

AI in digital payments looks at huge amounts of information, which allows payment systems to get smarter, work faster, and run more. These systems adapt to how people use them and what’s happening in the market, all while following rules and keeping things safe. In simple terms, AI changes old-school payment methods into clever automatic solutions that fit what people want in today’s digital world.

Q. How is AI Being Used in Payments?

A. AI in digital payments transforming the payments sector through diverse cutting-edge solutions. It enhances transaction efficiency by detecting patterns and refining processes, delivering quicker and more dependable payment services. AI in digital payments tracks payment activities for potential threats, employing advanced algorithms and user behavior monitoring to combat fraud and minimize financial exposure.

Moreover, the role of AI in digital payment simplifies billing management, subscription processing, and payment matching operations, enhancing accuracy and productivity. It creates customized payment experiences by delivering relevant recommendations based on transaction history. From enabling tap-to-pay solutions and cross-border transfers to facilitating digital currency adoption, AI boosts versatility and performance throughout payment operations.

Q. What Businesses Should Use AI for Payments?

A. Understanding the role of AI in digital payment offers significant advantages to organizations across sectors, with particular value for specific business types.

Digital retailers processing numerous transactions can utilize AI for payment fraud activity instantly and streamline payment operations. Financial technology companies and banks must implement AI to deliver robust payment platforms, including digital payment solutions and specialized processing systems.

Companies operating on recurring revenue models, like media streaming platforms or cloud software companies, can deploy AI to streamline payment collection and boost client loyalty through customized solutions. Multi-national retail operations can leverage AI to handle multiple payment types and international currencies.

Organizations seeking to boost productivity, strengthen payment security, and provide exceptional user experiences in today’s digital marketplace should explore AI payment technology integration.

Q. How does artificial intelligence in the payments industry improve security?

A. Artificial intelligence in the payments industry enhances security by deploying advanced algorithms to continuously monitor and analyze transaction data. Machine learning technology in payment processing strengthens protection through sophisticated algorithms that constantly evaluate transaction patterns.

Artificial intelligence in digital payments recognizes irregularities, spots fraudulent behavior, and identifies questionable activities instantly, reducing monetary risks. Capabilities such as biometric verification and user behavior monitoring add extra layers of security against unwanted entry. By dynamically responding to new security challenges, machine learning in payment systems delivers comprehensive safeguards for companies and consumers, building confidence in electronic payments.

Q. Which businesses benefit from artificial intelligence in the payments industry?

A. Artificial intelligence in the payments industry benefits many businesses, particularly those with high transaction volumes or complex payment needs. E-commerce platforms, fintech companies, and global retailers use AI to streamline payment processing and support diverse payment methods. Subscription-based services leverage it for automated billing and customer insights, while financial institutions rely on AI for payment fraud prevention and compliance. Any business seeking to optimize operations, enhance security, and stay competitive in the digital marketplace can gain significant advantages from artificial intelligence in the payments industry.

Q. How does AI in payment processing reduce transaction costs?

A. AI in payment processing lowers transaction costs by automating repetitive tasks and minimizing errors that lead to financial losses. AI streamlines operations like payment reconciliations, currency conversions, and chargeback management, reducing the need for manual intervention and associated labor costs.

Q. Why should small businesses adopt artificial intelligence in digital payments?

A. Small businesses should adopt artificial intelligence in digital payments to stay competitive and meet customer expectations in a digital-first world. AI offers cost-effective solutions like automated invoicing and fraud detection, reducing operational overheads and financial risks.

It also enables small businesses to provide secure, modern payment options—such as mobile wallets or QR codes—that appeal to tech-savvy customers. By leveraging artificial intelligence in digital payments, small enterprises can enhance efficiency, build trust, and expand their reach without requiring extensive resources.

Q. What are some generative AI use cases in payments to improve customer support?

A. Generative AI use cases in payments include enhancing customer support through advanced automation and personalization. For instance, generative AI powers intelligent chatbots to resolve payment-related queries—like transaction disputes or refund requests—in real time by generating human-like responses. It can also create tailored troubleshooting guides or payment instructions based on user input, reducing response times and improving customer satisfaction in payment systems.

Q. How will the future of AI in payments impact transaction speed and scalability?

A. The future of AI in payments promises to revolutionize transaction speed and scalability by leveraging advanced algorithms and real-time data processing. Thanks to predictive analytics and automated optimization, AI will enable payment systems to handle exponentially higher transaction volumes with minimal latency.

Chirag Bhardwaj is a technology specialist with over 10 years of expertise in transformative fields like AI, ML, Blockchain, AR/VR, and the Metaverse. His deep knowledge in crafting scalable enterprise-grade solutions has positioned him as a pivotal leader at Appinventiv, where he directly drives innovation across these key verticals. Chirag’s hands-on experience in developing cutting-edge AI-driven solutions for diverse industries has made him a trusted advisor to C-suite executives, enabling businesses to align their digital transformation efforts with technological advancements and evolving market needs.

10 Ways Generative AI is Transforming the eCommerce Industry

Key takeaways: Moving from experimental to essential for online businesses Companies like Amazon are seeing massive adoption with their AI tools Early adopters are gaining significant competitive advantages across operations Implementation costs are dropping while returns are increasing substantially The technology is transforming everything from customer service to inventory management Do you remember your last…

Unveiling 10 Use Cases, Benefits and Examples of Physical AI

Ever wondered what factory work will look like in the next 10 years? Just visit a Tesla facility. Most people know Tesla uses industrial robots for assembly, painting, and welding. What’s different now is their Optimus project: humanoid robots designed to handle physical tasks throughout their manufacturing facilities. This technology has moved well beyond concept…

How to Build an AI Copilot for Enterprises? Process, Costs, and Features

Key takeaways: Strategic Planning: Define target use cases, user personas, and pain points to align Enterprise AI Copilot development with business goals. Feature Design: Incorporate context-awareness, anticipatory help, and actionable interfaces for intuitive, high-value AI Copilot functionality. Technical Foundation: Select robust LLMs, implement RAG, and build a secure, scalable AI stack for seamless enterprise integration.…

B-25, Sector 58,

Noida- 201301,

Delhi – NCR, India

79, Madison Ave

Manhattan, NY 10001,

USA

Appinventiv Australia,

East Brisbane

QLD 4169, Australia

3rd Floor, 86-90

Paul Street EC2A 4NE

London, UK

Tiger Al Yarmook Building,

13th floor B-block

Al Nahda St – Sharjah

Suite 3810, Bankers Hall West,

888 – 3rd Street Sw

Calgary Alberta

Full stack mobile (iOS, Android) and web app

design and development agency

Appinventiv is the Registered Name of Appinventiv Technologies Pvt. Ltd., a mobile app development company situated in Noida, U.P. India at the street address – B- 25, Sector 58, Noida, U.P. 201301.

All the personal information that you submit on the website – (Name, Email, Phone and Project Details) will not be sold, shared or rented to others. Our sales team or the team of mobile app developers only use this information to send updates about our company and projects or contact you if requested or find it necessary. You may opt out of receiving our communication by dropping us an email on – info@appinventiv.com

1600+ transformation engineers delivered

3000+ game-changing products.

We chose Appinventiv to build our financial literacy and money management app from start to finish. From the first call, we were very impressed with Appinventiv’s professionalism, expertise, and commitment to delivering top-notch results.

It has been a pleasure working with Appinventiv. The team is not only extremely versatile and competent but also very professional, courteous, and responsive. We certainly plan to continue working with Appinventiv for an indefinite period.

We took a big leap of faith with Appinventiv who helped us translate our vision into reality with the perfectly comprehensive Edamama eCommerce solution. We are counting to get Edamama to launch on time and within budget, while rolling out the next phase of the platform with Appinventiv.

I just want to take a moment to thank the entire Appinventiv team for your incredible support. We truly appreciate everything you’ve done, and we’re excited to continue working together as we grow here at KODA

After researching numerous companies, we finally found Appinventiv, and it was the best decision we could have made. They successfully addressed the challenges with our existing app and provided solutions that exceeded our expectations.

We approached Appinventiv with a clear vision to build a robust and future-ready platform that could seamlessly integrate with the busy lifestyle of our customers while uplifting their overall experience and giving us a competitive edge.

1600+ transformation engineers delivered

3000+ game-changing products.

Connect with our consultation experts to get:

Insights specific to your business needs

Roadmap to overcome your challenges

Opportunities to scale your business in this niche.